michigan sales tax exemption nonprofit

The General Sales Tax Act by Public Act 156 of 1994 for sales to nonprofit organizations. We can help you obtain your tax-exempt status for your Michigan nonprofit by helping you complete and file IRS Form 1023 and include the.

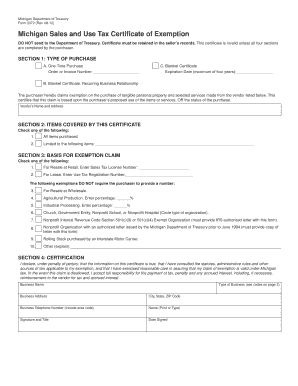

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

This page discusses various sales tax exemptions in Michigan.

. All organizations except those classified as churches are required to file an annual 990 form 990N 990EZ 990 or 990PF to be exempt from Income Tax. Organizations exempted by statute organizations granted exemption from Federal Income Tax under Internal Revenue Code Section 501c3 or 501c4 or organizations that had previously received an exemption letter from. The exemption certificate is 3372 Michigan Sales and Use Tax Certificate of Exemption.

Many nonprofits can benefit from being exempt from sales tax on purchases of services goods and materials. The first was a. 01-21 Michigan Sales and Use Tax Certificate of Exemption.

Enclose check or money order payable to the State of Michigan when submitting a report by mail or pay with credit card when filing online. Effective March 28 2013 certain charitable organization in the state of Michigan will be eligible for a sales tax exemption on purchases of personal property worth 5000 or less. All claims are subject to audit.

Do not send a copy to Treasury unless one is requested. But the one tax exemption that even nonprofits sometimes find elusive is sales tax. Several examples of exemptions to the states.

4q 1 A sale of tangible personal property not for resale to the following subject to subsection 5 is exempt from the tax under this act. 1 day agoIn 1994 Michigan voters approved Proposal A which increased the rates of the state sales and use taxes from 4 percent to 6 percent and. Seller name address make sure the name listed on the certificate matches the name on the customer.

Form 3372 Michigan Sales and Use Tax Certificate of Exemption. This exemption claim should be completed by the purchaser provided to the seller and is not valid unless the information in all four sections. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors making a claim for exemption from sales or use tax.

These exempt sales must not involve property used in commercial enterprises. For this discussion we include use tax when using the term sales tax With sales tax rates approaching 10 in some jurisdictions that combine state and local sales. 2019 Sales Use and Withholding Taxes Amended Annual Return.

Each item needs to be filled in and not left blank. Michigan has a 6 statewide sales tax rate and does not allow. On or before October 1 of each year beginning the year after incorporation.

Michigan Department of Treasury 5082 Rev. On november 4 2021 governor gretchen whitmer signed public act 108 of 2021 into law which exempted feminine hygiene products from michigans 6 sales tax. The exemption was expanded to all federal income-tax-exempt organizations under section 501 c3 or 501 c4 of the Internal Revenue Code IRC.

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. A A health welfare educational cultural. Churches Sales to organized churches or houses of religious worship are exempt from sales tax.

All claims are subject to audit. Also sales or rentals to the federal government its agencies and instrumentalities to the State or its departments institutions or political subdivisions or to the American Red Cross are exempt. Michigan sales tax exemption lookup.

Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Charities may however need to present an exemption certificate in order to receive an exemption on a purchase.

When completing a sales tax exemption certificate a nonprofit should be certain to complete the form in full and avoid an simple mistakes that may delay processing. Most nonprofits are exempt from federal and state income tax and they are also frequently exempt from real property tax. Sales Tax Exemption Certificate Validity Checklist.

Sales Tax Exemptions in Michigan. Following are the essential annual report requirements. Some of the states that allow for sales tax exemption require that you have already received your 501c3 status from the IRS.

Michigan Sales Tax Exemption for a Nonprofit Michigan automatically exempts eligible charities from sales tax so there is no need to apply for an exemption. For more information access the Michigangov guidelines. As with sales tax two exemption avenues were established by Public Act 424.

You will need to submit a Certificate of Exemption to each vendor along with a copy of your IRS determination letter. Ad New State Sales Tax Registration. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

Sales Tax Exemption information registration support. 04-18 Page 1 of 2 Issued under authority of Public Acts 167 of 1933 94 of 1937 and 281 of 1967 all as amended. You will have to provide proof that your organization is Michigan non-profit.

Any non-profit organization that is eligible to claim a federal exemption would use this form to claim an exemption from. Non-qualified transactions are subject to tax statutory penalty and interest. Sales or rentals to qualified non-profit health welfare education charitable and benevolent institutions religious organizations and hospitals are not subject to sales and use tax.

For Resale at Wholesale. Michigan Department of Treasury 3372 Rev. Michigan 501 c 3 nonprofits are exempt from paying sales tax on purchases.

Due to a change in the law regarding nonprofit organizations the Department of Treasury no longer has an application for exemption process. The following exemptions DO NOT require the purchaser to provide a number. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

Contractor must provide Michigan Sales and Use Tax Contractor Eligibility Statement Form 3520. Church Government Entity Nonprot School or Nonprot Hospital Circle type of organization.

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

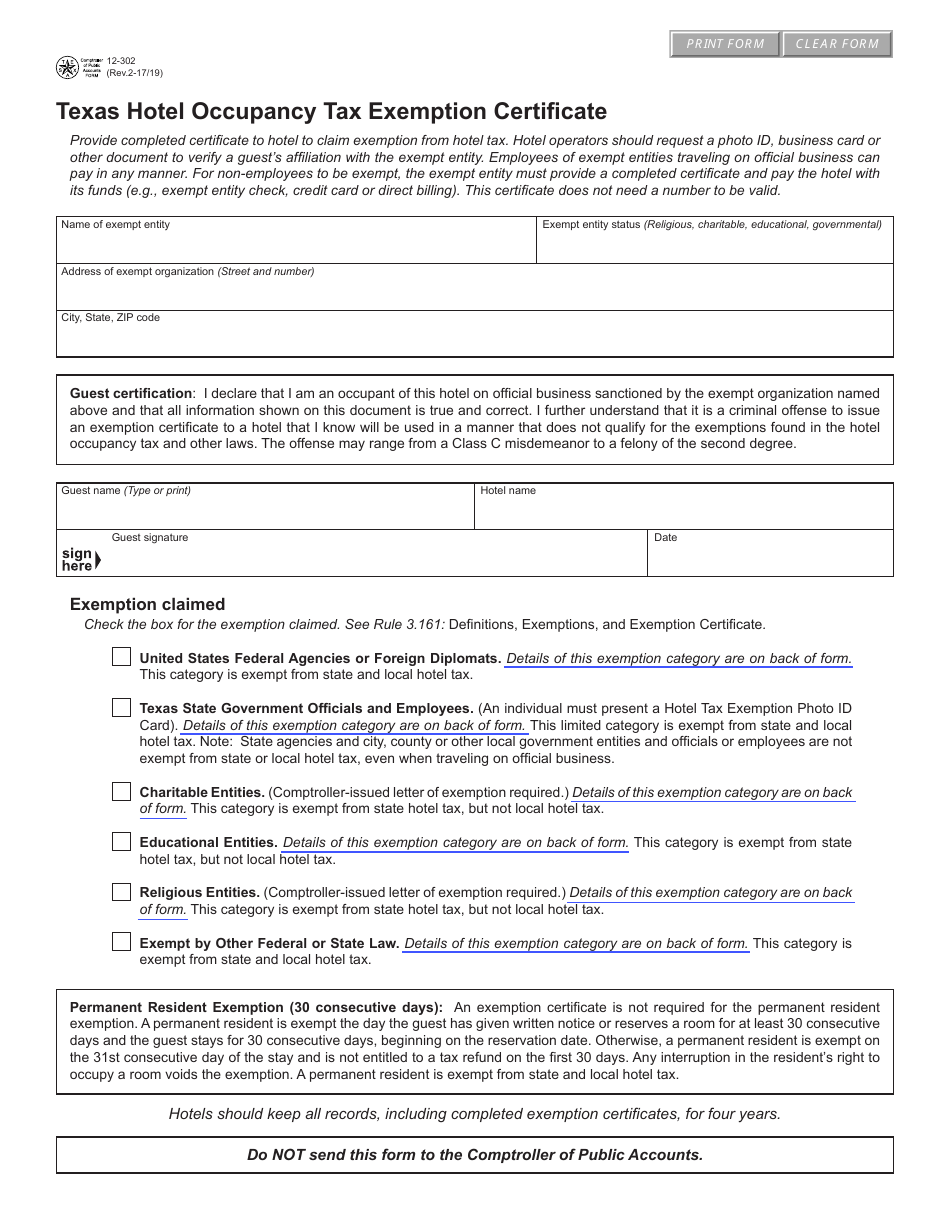

Form 12 302 Download Fillable Pdf Or Fill Online Hotel Occupancy Tax Exemption Certificate Texas Templateroller

Michigan Sales And Use Tax Certificate Of Exemption

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

2021 Form Mi Dot 3372 Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Sales Tax Exemption For Building Materials Used In State Construction Projects

Sales And Use Tax Regulations Article 3

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

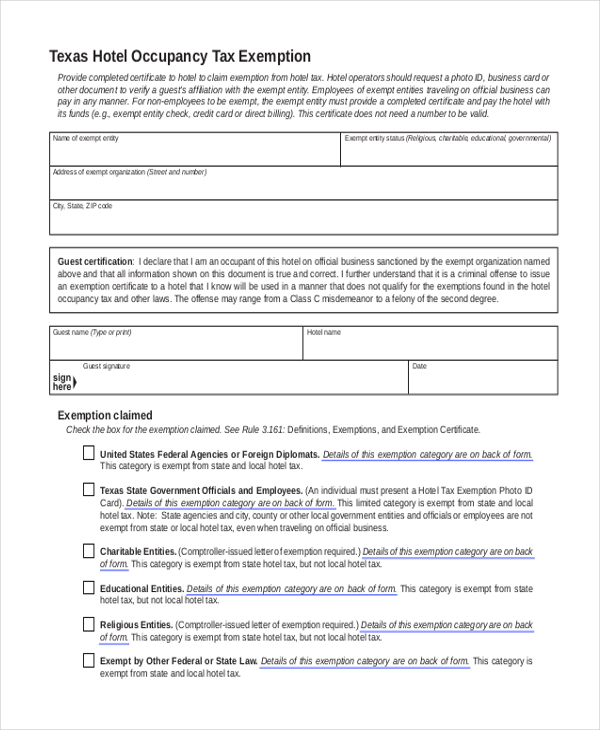

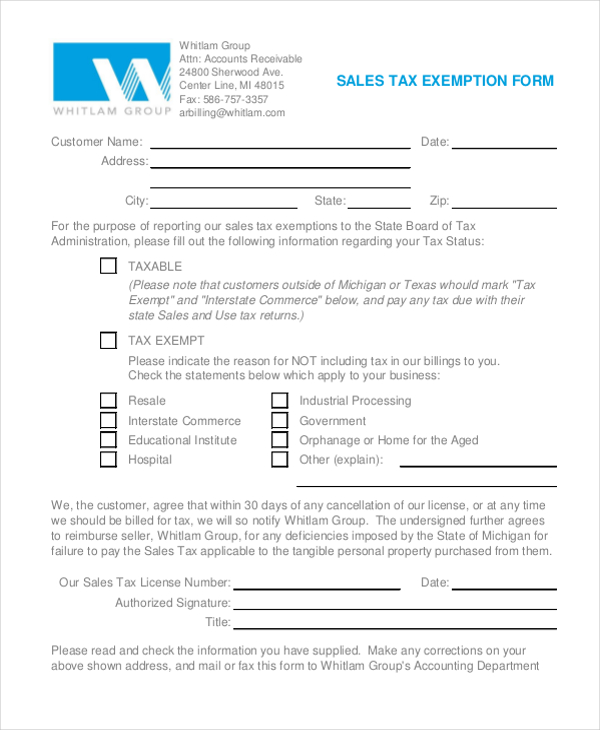

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

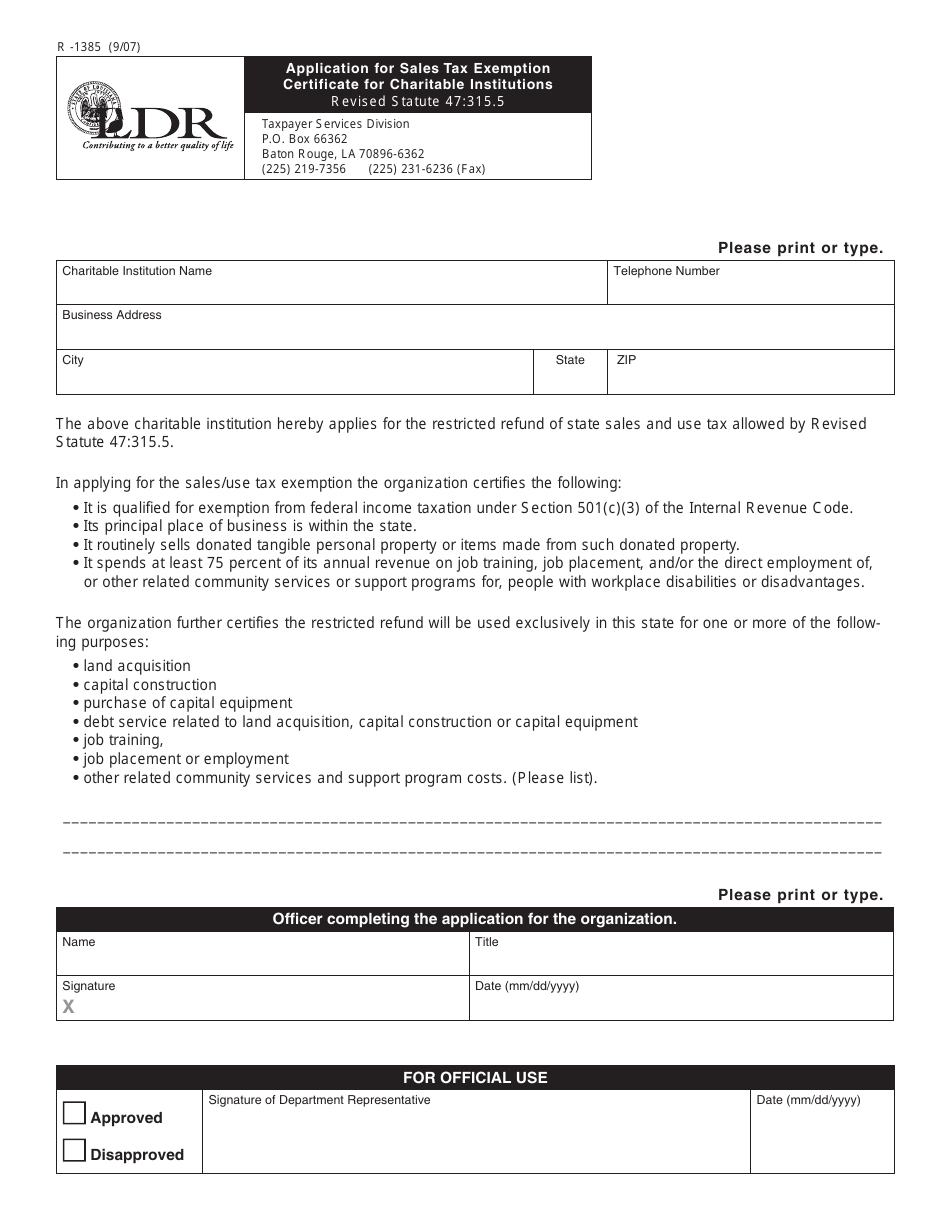

Form R 1385 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate For Charitable Institutions Louisiana Templateroller