pa estate tax exemption

In addition to the property tax exemption for veterans Pennsylvania has a Property TaxRebate program that is used to help senior citizens and disabled persons. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed.

Here Are The 2020 Estate Tax Rates The Motley Fool

Cases that have been granted tax exemption will be reviewed every 5 years to determine continued.

. This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax. To provide real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the Commonwealth and has financial need. 1 Organization must be tax-exempt under the Internal Revenue Code.

The Disabled Veterans Tax Exemption provides real estate tax exemption for any honorably discharged veteran who is 100 disabled is a resident of the Commonwealth of Pennsylvania. As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the. Estates and trusts are taxpayers for Pennsylvania personal income tax purposes.

The tax rate varies. 45 for any asset transfers to lineal heirs or direct descendants. This tax relief program uses.

Pennsylvania Department of Revenue Tax Types Sales. A transaction in which all parties are excluded parties under 91192 a relating to excluded parties is excluded from tax. Doylestown PA 18901 Phone Toll.

The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. A letter of exemption request needs to address the basis for the proposed tax-exempt status of the property in question and include any relevant information establishing this status. 12 for asset transfers to siblings.

FORM TO THE PA DEPARTMENT OF REVENUE. A rate of six percent applied to assets that passed to so-called lineal descendants such as children grandchildren and. They are required to report and pay tax on the income from PAs eight taxable classes of income that.

Property TaxRent Rebate Status. Wheres My Income Tax Refund. Did you know Pennsylvania has a program that provides real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the commonwealth.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. 2 No part of the organizations net income can inure to the direct benefit of any individual. West Chester PA 19381 Phone.

The federal estate tax exemption for 2022 is 1206 million. 15 for asset transfers to other heirs. TAX 2012 2 modities ricultural U e following Estate Tax imal produ ercial purp land less r improvem ands used uty and op inatory ba e of produ ting the re ursuant to deral agen tocked.

Other transactions which are excluded. Traditionally the Pennsylvania inheritance tax had two tax rates. The County Board for the Assessment and Revision of Taxes will grant the tax exemption.

The tax rate is. The estate tax exemption is often adjusted annually to reflect changes in inflation every year. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed.

Pa Elder Estate Fiduciary Law Blog Family Farms Exempted From Pa Inheritance Tax

Irs Announces Higher Estate And Gift Tax Limits For 2020 Senior Law

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Pa Tax Exemption For Family Owned Businesses Supinka Supinka Pc

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Do I Pay Pa Inheritance Tax If My Relative Lives Out Of State

Why Retire In Pa Best Place To Retire Cornwall Manor

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Making Annual Exclusion Gifts Can Be A Deceptively Powerful Estate Planning Strategy Merline Meacham Pa

If The Federal Estate Tax Exemption Is Reduced In The Future Will Your Estate Be Penalized

New Change To Pennsylvania Inheritance Tax Law Takes Effect

The Increased Federal Estate Tax Exemption Doesn T Decrease The Need For Wills And Estate Plans Mcandrews Law Firm

Inheritance Tax How It Works And Who S Exempt Magnifymoney

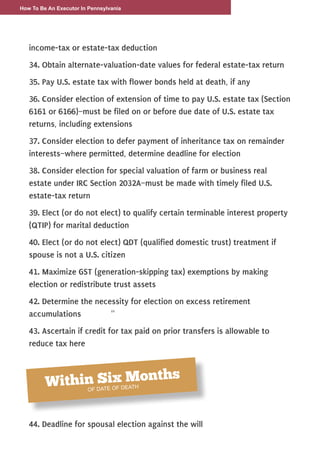

How To Be An Executor In Pennsylvania Patti Spencer

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Your Estate Is Taxed Or Not

11 Million Reasons To Review Your Estate Planning Law Offices Of John Mangan P A